Hi folks,

In this write-up, I cover how the majority of DeFi activities are currently debit-based, such as over-collateralized lending. But to truly disrupt the legacy financial system, DeFi needs to expand to a credit-based system, such as undercollateralized lending.

Here are the quick takeaways:

DeFi can create a more equitable financial system and provide easier access to capital in our increasingly digital and globalized world.

DeFi in the current debit-based system will not unlock new primitives that can further real-life use-cases.

DeFi needs to expand into a credit-based system in order to truly disrupt traditional finance.

Emerging markets will benefit the most from DeFi credit expansion in the short term due to increasing USD accessibility.

A crypto-native credit scoring system is necessary to effectively expand DeFi into the real economy, and even some centralization tradeoffs in the short term.

In today’s issue:

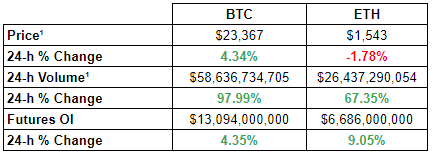

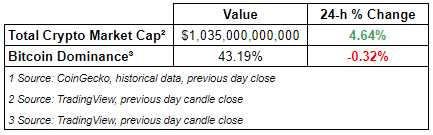

The crypto market is up with its total market cap above ~$1 trillion. ECOMI (OMI) is the best performer in the top 100 in the past 24-h. Stocks rally as optimism slowly returns to the markets.

In other news, Vauld owes $363M to retail investors, Scaramucci’s Skybridge halts withdrawals, and ZipMEX exchange halts withdrawals.

We’re continually improving our content, please reach out if you have ideas or want us to recap another market segment.

- Curated by Marco Manoppo (@manoppomarco)

📰Market News

⎆Vauld Owes $363M to Retail Investors

The crypto lender that halted client withdrawals last month reportedly owes $363M to retail investors. The firm owes approximately $125M to its 20 largest unsecured creditors and is seemingly in the process of getting acquired by Nexo.

⎆Scaramucci’s Skybridge Halts Withdrawals

Anthony Scaramucci’s Skybridge Capital halted withdrawals after one of its funds experience sharp declines in equities and crypto assets. The fund is called Legion Strategies and it needs to suspend redemptions as private companies now make up ~20% of its portfolio. The size of the fund is approximately $230M.

⎆ZipMEX Exchange Halts Withdrawals

Southeast Asia-based crypto exchange ZipMEX halted withdrawals citing market volatility. The firm reportedly has 2 million users and was about to be acquired by Coinbase earlier this year before the deal fell through in June.

👨🏻💻Decentralized Finance (DeFi)

Dune Live on Arbitrum

Revert Launches Fee Auto-compounding for Uniswap v3 LPs

Strips Finance v2 Soon

Scroll Pre-alpha Testnet

Aave Taps Pocket Network to Beef up Decentralized App Development

Figment Will Support MEV After Ethereum Merge

Fedi to Build Privacy-Focused Bitcoin Mobile App on Fedimint Protocol

CyberConnect Launches Link3 for Secure Networking

Polygon Deploys ZK Rollup Testnet; Eyes Mainnet Launch

🏛Governance - Active Proposals

Gitcoin - Gitcoin Treasury Diversification (Part 1)

🦮NFT & Metaverse

Amazon.eth ENS Domain Owner Disregards 1M USDC Buyout Offer

Twitter Hack Hits the NFT Community

GameStop’s NFT Marketplace Opening Week Sales Eclipse Coinbase Volume

Audius to Allow Users to Tip Artists Using Audio Token

Top Sales (Last 24-h); Source: https://dappradar.com/nft

📈Deal Flow & Capital Raise

Hulk Labs - Undisclosed $ Strategic Round

veToken Finance - Undisclosed $ Seed Round

Fedi - $4.2M Seed Round

XLD Finance - $13M Pre-series A

Halborn - $90M Series A

Zebedee - $35M Series B

Modular Capital - $20M Crypto Fund

⚖️Regulatory Update

SEC’s Gary Gensler Sees Plenty of ‘Noncompliance’ Across Crypto Industry

'Singapore' Crypto Firms Leading Market Meltdown Were Not Regulated

Colombia Advances Regulatory Framework for Local Crypto Industry

UK Regulators to Introduce Rules for Stablecoins in New Markets Bill

US Federal Agency Issues Legal Advisory on NFT Investments

📚Noteworthy Reads

Ming Zhao’s Thread on Exposé on the Dark Side of Market Structure

Dovey Wan’s Thread on The Darker Triad in Crypto

DeFi Surfer’s Read on Coinbase is NGMI

Feel free to reach out to manoppomarco@gmail.com — feedbacks and constructive criticisms are much appreciated.

DISCLAIMER:

All the information presented on The WAGMI Journal publication and its affiliation is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.