Hi folks,

In this write-up, I cover how the majority of DeFi activities are currently debit-based, such as over-collateralized lending. But to truly disrupt the legacy financial system, DeFi needs to expand to a credit-based system, such as undercollateralized lending.

Here are the quick takeaways:

DeFi can create a more equitable financial system and provide easier access to capital in our increasingly digital and globalized world.

DeFi in the current debit-based system will not unlock new primitives that can further real-life use-cases.

DeFi needs to expand into a credit-based system in order to truly disrupt traditional finance.

Emerging markets will benefit the most from DeFi credit expansion in the short term due to increasing USD accessibility.

A crypto-native credit scoring system is necessary to effectively expand DeFi into the real economy, and even some centralization tradeoffs in the short term.

In today’s issue:

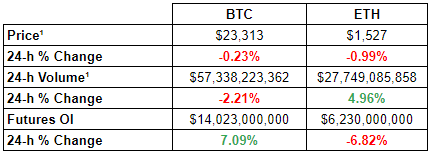

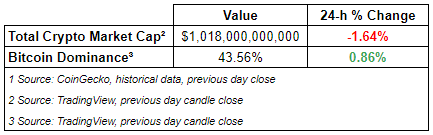

The crypto market is up with its total market cap above ~$1 trillion. Cosmos (ATOM) is the best performer in the top 100 in the past 24-h. The ECB hiked its rate by 50 bps.

In other news, Tesla sold $936M worth of BTC in Q2 2022, FTX seeks more funding after buying spree, and Coinbase announces no exposure to troubled crypto lenders.

We’re continually improving our content, please reach out if you have ideas or want us to recap another market segment.

- Curated by Marco Manoppo (@manoppomarco)

📰Market News

⎆Tesla Sold $936M Worth of Btc in Q2 2022

Tesla had sold $936M worth of BTC or approximately 75% of its holdings in Q2 2022 according to its earnings report. Musk said during the earnings call that the company needs to maximize its cash position given the current market condition.

⎆FTX Seeks More Funding After Buying Spree

Crypto exchange FTX is reportedly seeking more funding after it went on a buying spree in order to “save” the crypto market and acquire/aggregate more users under its suite of platforms.

In January, FTX announced it raised $400 million at $32 billion valuation, while FTX US raised a separate $400 million at an $8 billion valuation.

⎆Coinbase Announces No Exposure to Troubled Crypto Lenders

The largest crypto exchange in the US proudly announced that it has no exposure to troubled crypto lenders including Celsius, 3AC, or Voyager. The publicly traded firm stated that it is “focused on building our financing business with prudence and deliberate focus on the client”.

👨🏻💻Decentralized Finance (DeFi)

Polygon Introduces Polygon zkEVM

MetaMask Mobile will be compatible with the Nano Ledger X soon

Dune Supports Avalance

Uniswap: Proposal To Turn On ‘Fee Switch’ Gains Early Support

sUSD Bridge is Live'

zkSync 2.0 will be Launching on Mainnet in 100 days

Vyper is now Supported on zkSync 2.0 Testnet

Across’ Referral Program Is Now Live

Friktion Introduces Capital Protection

🏛Governance - Active Proposals

Gitcoin - Gitcoin Treasury Diversification (Part 1)

🦮NFT & Metaverse

Mojang Studios Bans Minecraft NFT Integrations

Final Fantasy NFTs Coming to Polkadot in Square Enix, Enjin Alliance

Ethereum NFT Whale Loses $150K on a Meme Gone Wrong

Premint to Return $500K in Ethereum to NFT Hack Victims

Outside Magazine Wants the Metaverse to Take a Hike

Sandbox Brings on Security Firm BrandShield to Prevent Rising NFT Fraud

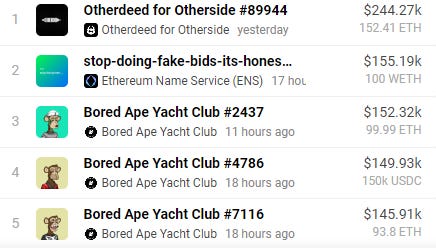

Top Sales (Last 24-h); Source: https://dappradar.com/nft

📈Deal Flow & Capital Raise

FitR - Undisclosed $ Seed Round

Zharta - $4.3M Seed Round

Secure3 - $5M Seed Round

Optic - $11M Seed Round

Veremark - $8.5M Series A

KuCoin - $10M Strategic Round from Susquehanna

⚖️Regulatory Update

Korean Prosecutors Raid Crypto Exchanges in Terra Probe

Stablecoin Firms Face Tough Reserve, Capital Demands in US Bill, Source Says

UK Markets Bill Extends Banking Rules to Crypto Assets

US Federal Agency Issues Legal Advisory on NFT Investments

South Korea Postpones 20% Tax on Crypto Gains to 2025

📚Noteworthy Reads

Sinderman’s Read on Why do our stables keep failing?

Delphi Digital’s Read on The Future of (Crypto) Gaming

David Hoffman’s Read on The New Supreme Court [LITE]

Feel free to reach out to manoppomarco@gmail.com — feedbacks and constructive criticisms are much appreciated.

DISCLAIMER:

All the information presented on The WAGMI Journal publication and its affiliation is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.