📈Stepn Generates $122M Profits in Q2 2022 - TWJ #185

Parts of the net profit will be used to buy back and burn GMT.

Hi folks,

In this write-up, we present our thinking as to why not all NFTs are useless, and that the most strategic and practical use-case for NFTs is in the luxury space, tapping into the innate human behavior that wants exclusivity and status.

Here are the quick takeaways:

NFTs’ most pragmatic use case is tapping into the innate human behavior that seeks exclusivity and status.

NFT brands need to be honest and admit that their primary value add is tied to their brand, just like luxury goods.

Most NFT brands focus too much on the digital experience, which will be the biggest strategic mistake.

Creating experiences that combine physical and digital space via NFTs will be the true value unlock.

NFT use-cases in other sectors won’t grow until the regulatory landscape matures.

In today’s issue:

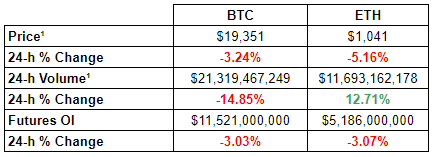

The crypto market is down with its total market cap at ~$800 billion. Lido DAO (LDO) is the best performer in the top 100 in the past 7-d. US CPI figure accelerates to 9.1%.

In other news, 3AC creditors’ first meeting is scheduled for July 18, Stepn to buy back and burn GMT with Q2 revenue, and BlockFi softens its stance on GBTC collateral.

We’re continually improving our content, please reach out if you have ideas or want us to recap another market segment.

- Curated by Marco Manoppo (@manoppomarco)

📰Market News

⎆3AC Creditor’s First Meeting to Take Place on July 18

The first meeting for 3AC’s creditors will happen on July 18. It will be hosted by Teneo, the court-appointed liquidator of 3AC. There is a dedicated website made by Teneo to update creditors with the latest developments around 3AC liquidation.

⎆Stepn to Buy Back and Burn GMT

Walk to earn app Stepn will conduct buyback and burn of its GMT token using its Q2 2022 revenue, which was approximately $122M. The dApp makes money via platform fees. The initiative is being done to accrue value back to GMT, the dApps’ governance token.

⎆BlockFi Softens Stance on GBTC

The Block originally reported that BlockFi will stop taking GBTC as collateral. The story was updated a few hours later.

“While we don't currently hold any positions in GBTC and are winding down a couple of loans where GBTC is part of the collateral package, we are not saying that we won't support GBTC as collateral moving forward. Like any collateral, we constantly evaluate appropriate collateral haircut ratios and aim to accept as many types of collateral that our clients hold as possible"

👨🏻💻Decentralized Finance (DeFi)

Lenstube is now Live on Polygon Mainnet

Connext $NEXT Token is Delayed

Helium Stops Producing Blocks Issue

Certora Discovers Potential Maker Exploit

Revolut x Polkadot to Launch Crypto Learn

🏛Governance - Active Proposals

Ampleforth - Set Proposal Threshold to 75k (current contract minimum)

ENS - Funding True Names Ltd

Uniswap - Optimism 1bp Fee Tier

🦮NFT & Metaverse

Korean Fintech Giant Plans to Create 10K Web3 Jobs amid Bear Market

US Trademark and Copyright Offices to Study IP Impact of NFTs

Yuga Hires Pepe the Frog Creator’s Attorney

Stepn Renews Token Burn Amid Ethereum Expansion

Framework Ventures Introduces Framework Tent

Shanghai Plans to Cultivate $52B Metaverse Industry by 2025

MoonPay to Make WEB3 Payments With Unstoppable Domains Partnership

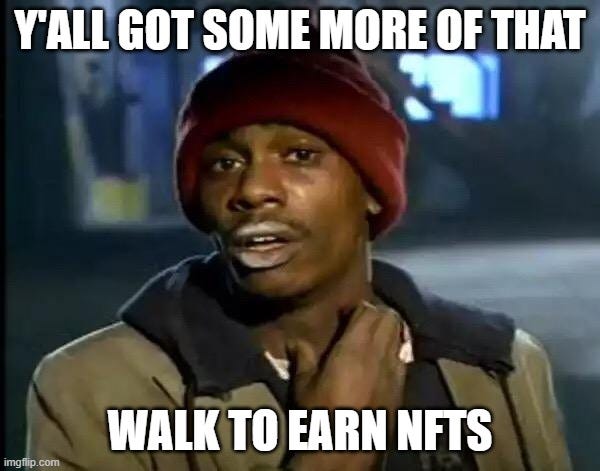

Top Sales (Last 24-h); Source: https://dappradar.com/nft

📈Deal Flow & Capital Raise

Crossover Market - Undisclosed $ Seed Round

Monopoly Millionaire Game - $1M Seed Round

MetaOasis DAO - $1.5M Seed Round

Qori - $1.8M Seed Round

Nevermind - $3M Seed Round

Tribute Brand - $4.5M Seed Round

Quadrata - $7.5M Seed Round

Morpho Labs - $18M Seed Round

⚖️Regulatory Update

California Is Investigating ‘Multiple’ Crypto Lending Companies

US Treasury Opens Door for Public Comments on Biden’s Crypto Order

US Federal Researchers: Digital Dollar Could Be Good for Financial Stability

Three Arrows Capital Liquidators Cleared by Judge to Issue Subpoenas

Three Arrows Capital Says Cooperation With Liquidators Met With 'Baiting'

Kazakh Crypto Mining Tax Hike Signed Into Law by President Tokayev

International Standard Setters Publish Guidance on Stablecoin Regulations

📚Noteworthy Reads

Frogs Anonymous’s Read on LP Diving: How To Hack Impermanent Loss

Patrick Hansen’s Thread on ECB Research

Covduk’s Thread on How to Use Etherscan Effectively in 5 Minutes

Feel free to reach out to manoppomarco@gmail.com — feedbacks and constructive criticisms are much appreciated.

DISCLAIMER:

All the information presented on The WAGMI Journal publication and its affiliation is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.