👴SEC Gensler Strikes Again - The WAGMI Journal #71

The SEC is continuing its probe into firms that pay interest in crypto deposits.

In today’s issue:

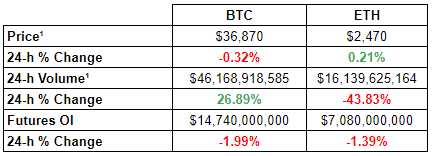

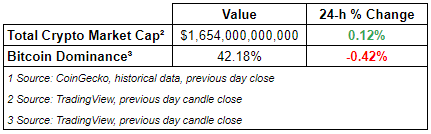

The crypto market is flat with the global market cap sitting at ~$1.7 trillion. Crypto markets are paying attention to the TIME Wonderland saga as it unfolds and anticipating the potential effects on other DeFi protocols. Powell endorsed an interest rate hike in March to contain inflation.

In other news, SEC continues to scrutinize crypto interest-payment, Binance plans to reinstate payments from EU’s SEPA, and Tesla reports its BTC holding was unchanged in Q4 21.

We’re continually improving our content, please reach out if you have ideas or would like us to recap another segment of the market.

- Curated by Marco Manoppo (@manoppomarco)

📰Market News

⎆SEC Scrutinizing Crypto Firms Over Interest-Paying Services

Unsurprisingly, the SEC continues to take steps in probing crypto firms that provide interest on crypto assets deposits including Voyager, Gemini, and Celsius. The agency has not officially decided on any outcome and is still pondering whether these firms should classify their offerings as securities due to the nature of the interest payment.

⎆Binance to Reinstate Payments From EU's SEPA

Having been under a lot of regulatory scrutinies in the past year, Binance had temporarily stopped payments from the EU SEPA region last year. The world’s largest crypto exchange has just announced that it will reinstate payments from the EU SEPA region, starting with Belgium and Bulgaria, expanding slowly throughout the bloc for the next few weeks.

⎆Tesla Reports Bitcoin Holdings Unchanged in Q4

Despite his recent criticisms towards web 3.0 and the broader crypto market, TSLA earnings report from Q4 21 showed that the firm’s BTC holdings remained the same at an approximate valuation of $1.26 billion. Musk is known for his affinity towards DOGE, but perhaps this provides a slight hope that BTC might be integrated with TSLA in a much more meaningful way.

👨🏻💻Decentralized Finance (DeFi)

Anchor Protocol Burns Through Its Reserves As Deposits Pile Up

Metamask’s New Inbuilt Multichain Institutional Custody Feature

Synthetix L222 Roadmap

Coinbase Close to Listing Solana Ecosystem Tokens

MakerDAO’s Expulsion of Content Team Stirs Debate

Tracer DAO Perpetual Pools V2 Coming Soon!

RLY Backer SuperLayer to Bring Social Tokens to Solana

SundaeSwap Switcheroo Leaves CardStarter Users With Losses

Diem to Sell Assets to Silvergate Bank for $200M

Avalanche-Based Wonderland Is Allegedly Run by Quadrigacx Co-founder

🏛Governance - Active Proposals

Cryptex - CIP-12: Q1 + Q2 Brand, Marketing & Development Budget

Fei - FIP-70: ETH/FEI Liquidity migration to Balancer

Fei - FIP-72: New DAI PSM

🦮NFT & Metaverse

MoonPay Rolls Out Credit Card Checkout Tool for NFT Purchases

NASA Blasts NFTs: Says They Won't Take Off with Its Imagery

Coinbase's VP of Product Demos Forthcoming NFT Platform

Reddit Is Testing Out NFT Profile Pics, but ‘No Decisions Have Been Made’

Warner Music Plots Metaverse Concerts in Ethereum Game The Sandbox

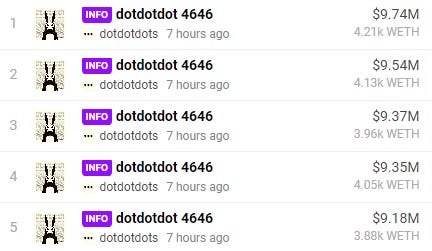

Top Sales (Last 24-h); Source: https://dappradar.com/nft

It was suspected that these trades were wash trading on the LooksRare marketplace.

📈Deal Flow & Capital Raise

TRLab - $4.2M Unknown Round

Prismatic - $2M Seed Round

HAL - $3M Seed Round

Flint - $5.1M Seed Round

Superdao - $10.5M Seed Round

Blockdaemon - $207M Series C

Railgun - $10M Strategic Partnership with DCG

Sandbox - $50M Incubator Program

CoinTracker - $100M Unknown Round

ZkSync - $200M Investment from Matter Labs, BitDAO

Apifiny - $530M SPAC Merger

⚖️Regulatory Update

Trezor Adopts Swiss Travel Rule Protocol for Private Crypto Wallets

Crypto Policy Advocacy Group Warns of ‘Disastrous’ Provision in a US Bill

Russian Finance Ministry Submits Crypto Regulatory Framework for Review

House of Representatives Schedules Hearing on Stablecoins for February 8

📚Noteworthy Reads

useWeb3’s Thread on 3 Main Layers of Web3

SynthaMan’s Thread on Synthetix 2022 Roadmap

Panda Jackson’s Thread on Stablecoin

Feel free to reach out to manoppomarco@gmail.com — feedbacks and constructive criticisms are much appreciated.