In today’s issue:

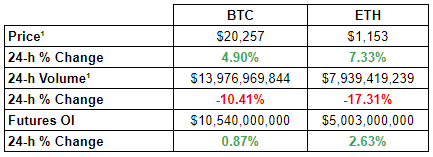

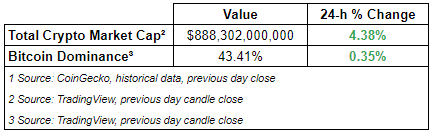

The crypto market is up with its total market cap at ~$800 billion. KuCoin (KCS) is the worst performer in the top 100 in the past 7-d. Euro continues to weaken against the USD.

In other news, MakerDAO votes to allocate $500M into minimal risk bonds, Singapore evaluates crypto safeguards after blowups, and KuCoin dismisses withdrawal fud.

We’re continually improving our content, please reach out if you have ideas or want us to recap another market segment.

- Curated by Marco Manoppo (@manoppomarco)

📰Market News

⎆MakerDAO to Allocate $500M Into Minimal Risk Bonds

MakerDAO has voted to allocate $500M into minimal-risk bonds and treasuries in order to generate yield during the bear market. It will be interesting to see the vested interests of various parties as well as some definitely centralized third parties that will be involved to make this possible. That said, it makes sense for Maker to pursue this given that yield from some bonds and treasuries, especially in EMs, have surpassed crypto-native yield.

To get a full overview of this Maker development, we also recommend reading the following:

⎆Singapore Evaluates Crypto Safeguards After Blowups

The Monetary Authority of Singapore is reportedly considering more crypto safeguards for retail investors as multiple Singapore-based crypto firms got blown up, with the latest one being Vauld, a lending platform backed by Thiel. Unfortunately, the regulators should focus on regulating these centralized entities instead of mulling more restrictions for retail investors.

⎆KuCoin Dismisses Withdrawal FUD

The exchange’s CEO Lyu took to Twitter to address the FUD and rumor surrounding the possibility that KuCoin might halt withdrawals to cover losses related to the recent market downturn. Lyu reiterated that KuCoin “does not have any exposure to LUNA, 3AC, Babel, etc.”

👨🏻💻Decentralized Finance (DeFi)

Ethereum Difficulty Bomb Delayed to Mid-September

ZigZag Exchange Introduces InvisibL3

TFM Live on Juno

Aura Passed the Audit from Halborn

DFX Pauses All Liquidity Pools

Multichain Adds Rootstock to Its Blockchain Bridge Ecosystem

Polkadot Builder Parity Technologies Adds 3 Execs to Leadership Team

🏛Governance - Active Proposals

Compound - Return Accidentally Sent Funds #3

🦮NFT & Metaverse

Alibaba, Tencent to Require ID Checks for NFT Purchases

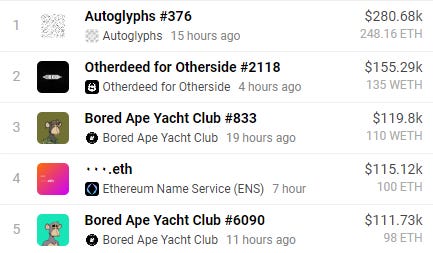

Top Sales (Last 24-h); Source: https://dappradar.com/nft

📈Deal Flow & Capital Raise

H2O Water Securities - $150M Unknown Round

BKN301 - $15.65M Series A

⚖️Regulatory Update

ECB Officials Prepare for ‘Harmonization’ of Crypto Regulations

UK Government Seeks Views on DeFi Taxation

NFT Platforms Should Be Caught by EU Money-Laundering Overhaul

Singapore's Central Bank Weighs Further Safeguards on Retail Crypto Trading

📚Noteworthy Reads

Wishful Cynic’s Thread on Aggregators, DEX Liquidity, and More

WuBlockchain’s Read on VC Monthly Report: Funding Overview in June

Andrew Beal’s Read on A Stupid Simple Governance Framework

Feel free to reach out to manoppomarco@gmail.com — feedbacks and constructive criticisms are much appreciated.

DISCLAIMER:

All the information presented on The WAGMI Journal publication and its affiliation is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.