🏦Goldman Sachs Seeks $2 Billion to Acquire Celsius - TWJ #173

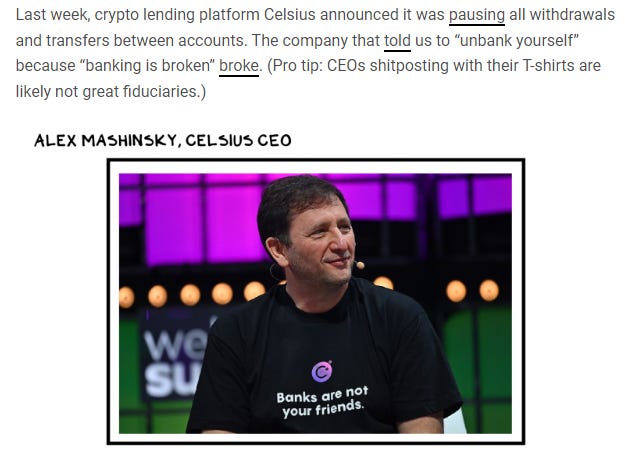

The firm that wants to un-bank its users is potentially acquired by a bank.

In today’s issue:

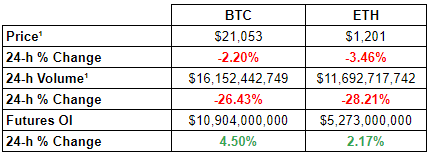

The crypto market is up with its total market cap at ~$900 billion. Polygon (MATIC) is the best performer in the top 100 in the past 7-d. Russia defaulted on its foreign-currency sovereign debt.

In other news, Goldman Sachs plans to raise $2 billion to buy Celsius’ assets, Harmony blockchain’s Horizon bridge offers a $1M bounty after a $100M hack, and Nexo threatens legal action against an anonymous Twitter account.

Credits: profgalloway.com/trustless/

We’re continually improving our content, please reach out if you have ideas or want us to recap another market segment.

- Curated by Marco Manoppo (@manoppomarco)

📰Market News

⎆Goldman Sachs Plans to Raise $2 Billion to Buy Celsius’ Assets

Goldman Sachs is reportedly raising $2 billion from investors to purchase Celsius’ assets. If the effort goes through, investors will acquire these distressed assets at discounts in the event of a bankruptcy filing.

Goldman seems to be soliciting commitments from web3 crypto funds, funds specializing in distressed assets and traditional financial institutions, according to a person cited in the report.

⎆Harmony Offers a $1M Bounty After a $100M Hack

The Harmony’s blockchain Ethereum-linked bridge, Horizon, was hacked for $100M. The protocol has since offered a $1M bounty for the hacker to return all of the exploited funds and that it would “advocate for no criminal charges”

⎆Nexo Threatens Legal Action Against an Anonymous Twitter Account

Crypto lender NEXO has also fallen under accusations from an anonymous Twitter account regarding various scandals. The firm retaliated by publishing (as a blog post…) its cease and desist letter.

👨🏻💻Decentralized Finance (DeFi)

Aave Exploit on Harmony

Arbitrum Live on Thirdweb

ENS Releases a New App

Horizon Bridge $1M Exploit Bounty

Magnety Live on Testnet

Vesta x Risk DAO Partnership

ApolloDAO is Looking to Launch Apollo Safe on Injective

Axie Infinity to Compensate Ronin Exploit Victims and Relaunch Bridge

THORChain Token Price up 16% Following Mainnet Launch

Convex Finance Sets Up New URLs After Website Address Is Hijacked

🏛Governance - Active Proposals

Compound - OpenZeppelin Security Partnership - 2022 Q3 Adjustment

Tribe NopeDAO - Veto for TIP 116: Pod Executor Upgrade

Tribe NopeDAO - Veto for TIP 115: Collateralization and Operations Updates

🦮NFT & Metaverse

LooksRare Conditional Listing is Live

Eminem and Snoop Dogg Turn into BAYC Chars in New Music Video

Yuga Labs Lawsuit Accuses Ryder Ripps of 'Scamming Consumers'

Bored Ape Founders Respond to 'Crazy Disinformation Campaign'

Salvatore Ferragamo Opens Ethereum NFT Booth in NYC

Top Sales (Last 24-h); Source: https://dappradar.com/nft

📈Deal Flow & Capital Raise

EyesFi - $2M Unknown Round

Eight XR - $820K Pre-seed Round

Cyan - $2M Seed Round

SithSwap - $2.65M Seed Round

System 9 - $5.7M Series A

Cryptoys - $23M Series A

Flowdesk- $30M Series A

Brave Group - $18M Series C

⚖️Regulatory Update

Dubai Regulator: Three Arrows Capital Isn’t Registered Here

Albania Plans to Begin Taxing Crypto-Derived Income NextYear

Nexo Threatens Legal Action Against Anonymous Twitter Account

Coinbase Users in the Netherlands to Face Additional KYC Hurdles When Pulling Crypto off Platform

Swiss National Bank Exec: Regulators May Favor Centralized Stablecoins After Terra Crisis

China’s BSN Chair Calls Bitcoin Ponzi, Stablecoins ‘Fine if Regulated'

📚Noteworthy Reads

Rektdiomedes’s Thread on Is The "L1 Rotation Trade" Dead?

Trail of Bits’s Read on Managing risk in blockchain deployments

Jb0x’s Read on To Rug or Not to Rug: Why is that a Question?

Feel free to reach out to manoppomarco@gmail.com — feedbacks and constructive criticisms are much appreciated.

DISCLAIMER:

All the information presented on The WAGMI Journal publication and its affiliation is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.