Goldman $100,000 BTC Prediction - The WAGMI Journal #55

Store of value combined with high-growth tech stocks potential.

In today’s issue:

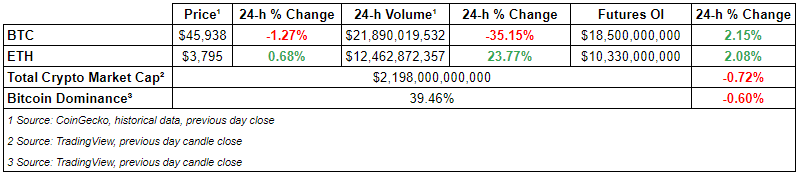

The crypto market is slightly down with the global market cap sitting at ~$2.2-2.3 trillion. MINA and ICP are amongst the top performers in the past 24-h, once again further showing the market’s appetite for layer 1 tokens. Global markets are concerned with the sharp moves in Treasuries as well as weakness in the tech sectors.

In other news, Goldman stated the probability of $100,000 BTC, OpenSea got valued at $13 billion, and ex-CFTC Giancarlo proposed a way to unify crypto regulations.

We’re continually improving our content, please reach out if you have ideas or would like us to recap another segment of the market.

- Curated by Marco Manoppo (@manoppomarco)

📰Market News

⎆Goldman Says Bitcoin $100,000 a Possibility

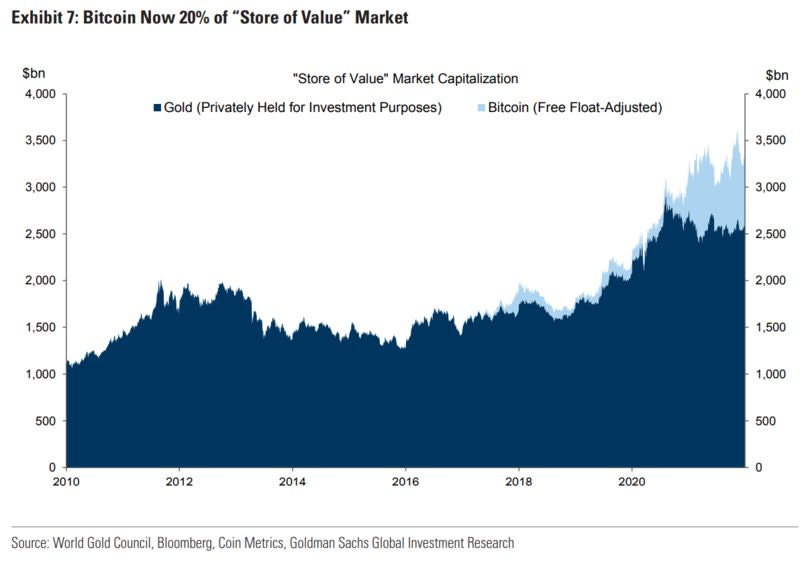

Predicting that BTC will continue to gain market share from gold, Goldman stated that a price of $100,000 per BTC is a possibility. Hypothetically, if the market size for the store of value assets increases by 50% over the next 5 years, then it is likely for BTC price to go over $100,000.

⎆OpenSea Valued at $13.3B in $300M Funding Round

As the NFT craze continues into the new year, the number one marketplace for NFTs finished raising its $300M Series C at a $13.3 billion valuation. This valuation is close to a 9x increase compared to the OpenSea series B raise 6 months ago. The firm went from a valuation of $1.5 billion to $13.3 billion. In the next 12-24 months, I predict that OpenSea will still continue to grow but experience a similar issue that Coinbase is facing; competitors will continue to lower the ludicrous fees that these platforms charge.

⎆Ex-CFTC Giancarlo Proposes a Way to Unify Crypto Regulation

During a panel hosted by the American Enterprise Institute, ex-CFTC chairman Giancarlo proposed a method to unify crypto regulations in the US, sounding Coinbase’s proposal for a single regulator for crypto assets. Both the CFTC and SEC have been actively trying to increase their oversight over crypto assets. However, the existing frameworks are not directly applicable due to the extremely complex nature of crypto assets.

👨🏻💻Decentralized Finance (DeFi)

Grayscale Adds Flexa’s AMP to DeFi Fund, Removes BNT, UMA

Osmosis Lights Up the Market with 80% Run in Last 14 Days

Giancarlo Assails ‘Defensive and Reactionary’ Crypto Policy and Calls for Single U.S. Watchdog

Defi Kingdoms Reaches Record Activity Levels on Top of Metaverse Push

🏛Governance - Active Proposals

Babylon Finance - BIP-7: Mining Adjustments

Elyfi - NAP12: Request for verification of ABToken

ENS - [EP2] Retrospective Airdrop

🦮NFT & Metaverse

Game Industry Will Rapidly Adopt NFTs Despite Backlash: Sandbox COO

Golf Startup Putts $10.5 Million in NFT Sales

Quentin Tarantino’s 'Pulp Fiction' NFTs Will Be Auctioned Despite Lawsuit

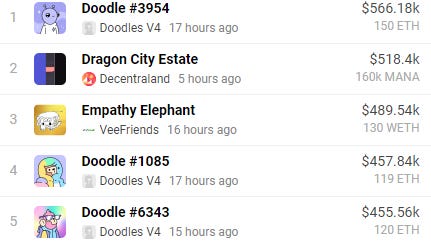

Top Sales (Last 24-h); Source: https://dappradar.com/nft

📈Deal Flow & Capital Raise

Cion - $12M Seed Round

Metaversal - $50M Series A

Livepeer - $20M Series B

OpenSea - $300M Series C

⚖️Regulatory Update

CoinDesk Joins Court Case Seeking Access to NYAG Tether Documents

SEC Delays Decision on NYDIG’s Spot Bitcoin ETF Proposal

Crypto.com Sees 2 Ads Banned by UK’s Advertising Regulator

📚Noteworthy Reads

Lauren Stephanian & Cooper Turley Read on Optimizing Token Distribution

Ansem’s Read on Quarter I 2022

OHM’s Zeus Read on 2021 OlympusDAO Outlook

Feel free to reach out to manoppomarco@gmail.com — feedbacks and constructive criticisms are much appreciated.