Ex Citi Exec $1.5B Crypto Fund - The WAGMI Journal #31

TradFi exodus to crypto will continue to increase.

In today’s issue:

The crypto market is up with the global crypto market cap sitting above $2.8 trillion. More data is needed to assess the Omicron variant, but it seems that the market stopped being paranoid about it. Besides, they will just print more money if we go into another lockdown. In other news, former Citi exec launched a $1.5 billion crypto fund, MicroStrategy raised its BTC holding to $7 billion, and Twitter seems to be testing Ethereum integration.

Starting today, our daily issue will be sent out before 9 am EST.

We’re continually improving our content — based on our readers’ suggestions, we are working to add:

a section showing open interest and other trading-related metrics 24-h changes

a section showing newly released projects

Please reach out if you have any other ideas or would like us to recap a segment of the market.

- Curated by Marco Manoppo (@manoppomarco)

📰Market News

⎆Hivemind Capital Partners $1.5 Billion Crypto Fund

Founded by a former Citi executive Matt Zhang, Hivemind Capital Partners has announced the launch of its $1.5B crypto fund, tapping former Goldman Sachs analysts Sam Peurifoy (aka Das Kapitalist) as the head of its play-to-earn gaming arm. The fund will focus on four strategies; trading, VC investments, P2E gaming, and yield farming/staking. We’re seeing more and more exodus from traditional finance to crypto. Deal flow dynamics will change as crypto founders can now choose to gain the support of a juggernaut fund and/or a more hands-on crypto-native type fund.

⎆MSTR Increases BTC Holding to $7 Billion

MicroStrategy’s CEO Michael Saylor has announced that the firm bought $414M more Bitcoin at an average price of just above $59,000, totaling the firm’s holding to approximately 121,044 BTC. People might call him crazy (fairly so), but I do admire his conviction.

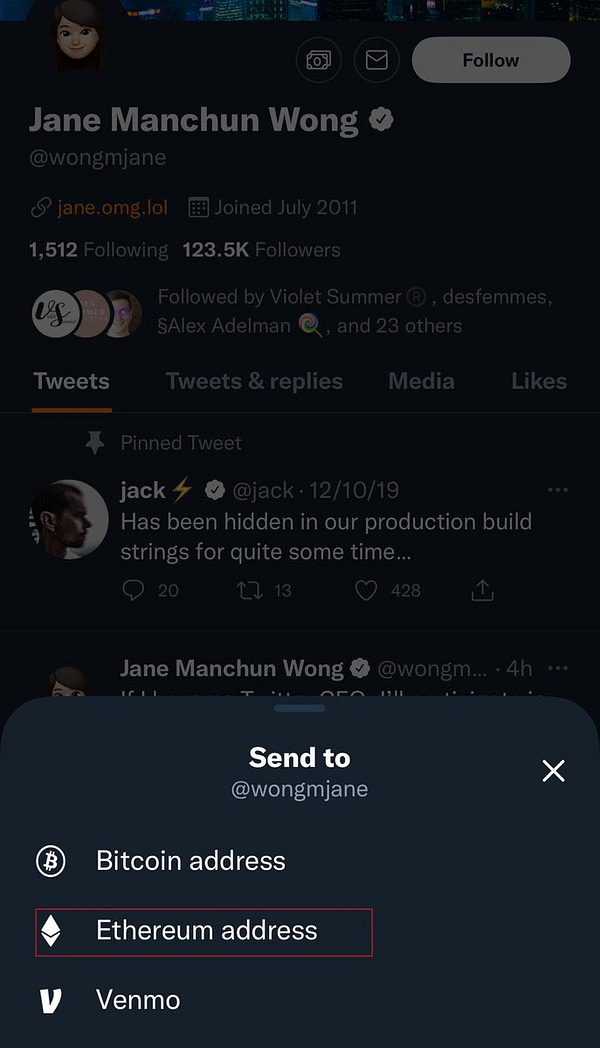

⎆A Hacker Added Ethereum Wallet to Twitter's Tip Jar

Jane Wong, a famous Hong Kong-based hacker who is known to tinker with code on apps to discover unreleased features has tweaked her own Twitter account to show more tipping options which include Venmo and Ethereum addresses. Wong said that the feature has been there since at least September, but is not widely available yet. The crypto community speculated that Jack’s departure may promote a more pro Ethereum culture at Twitter, especially considering the incoming CEO’s seemingly more friendly stance towards ETH.

👨🏻💻Decentralized Finance (DeFi)

Zero-Knowledge Pioneer StarkWare Launches Layer 2 Rollup Network

Ethereum Privacy Protocol Tornado Cash to Launch on L2 Arbitrum

Bancor Introduces New Staking Pools and Instant Impermanent Loss Protection

DeFi TVL Hits New Highs While Metaverse Tokens Show Signs of Exhaustion

MELD’s $1B ISPO Highlights Emerging Use Cases for Cardano, Crypto Fundraising

🏛Governance - Active Proposals

Fei - FIP-45: Angle Protocol Partnership

Elyfi - NAP7: Request for verification of ABToken

PoolTogether - PTIP-48: Grants Committee Funding (Season 2)

🦮NFT & Metaverse

Budweiser Launching Ethereum NFTs as ‘Key to the Budverse’

Snoop drops 'Decentralized Dogg' NFT like it’s hot

Top Sales (Last 24-h); Source: https://dappradar.com/nft

📈Deal Flow & Capital Raise

KingdomX - $2M Seed Round

MeanFi - $3.5M Seed Round

Unicly - $10M Seed Round

Korbit - $75M Stake Acquisition by SK Square

Galaxy Digital - $500M Senior Notes

Hivemind Capital Partners - $1.5B Crypto Venture Fund

⚖️Regulatory Update

NY Fed Launches Fintech Research Wing With BIS Help

Russians Conduct $5B Worth of Crypto Transactions a Year, Central Bank Says

Indonesia’s Central Bank Wants to ‘Fight’ Crypto With CBDC

📚Noteworthy Reads

Tim Roughgarden’s Read on A Theory of DeFi?

Jack Dorsey’s Email on Resigning From Twitter

Forward Analytics’s Thread on Future of Gamefi

Feel free to reach out to manoppomarco@gmail.com — feedbacks and constructive criticisms are much appreciated.

DISCLAIMER:

All the information presented on The WAGMI Journal publication and its affiliation is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, and any other forms of advice. Writers, authors, and contributors of The WAGMI Journal may hold any assets mentioned in the issue.