Hi folks,

My other publication, Pensive Pragmatism, is doubling down. We are launching a new weekly series called “pls fix: [topic]” where we will provide strategic recommendations for a specific protocol or sector in crypto. Crypto is innovating at a lightning pace; and while I don’t claim to have all the answers, I believe that documenting these ideas in public is a good first step to instigating further discussions. I hope you’ll share it if you find it enjoyable.

Here are the quick takeaways:

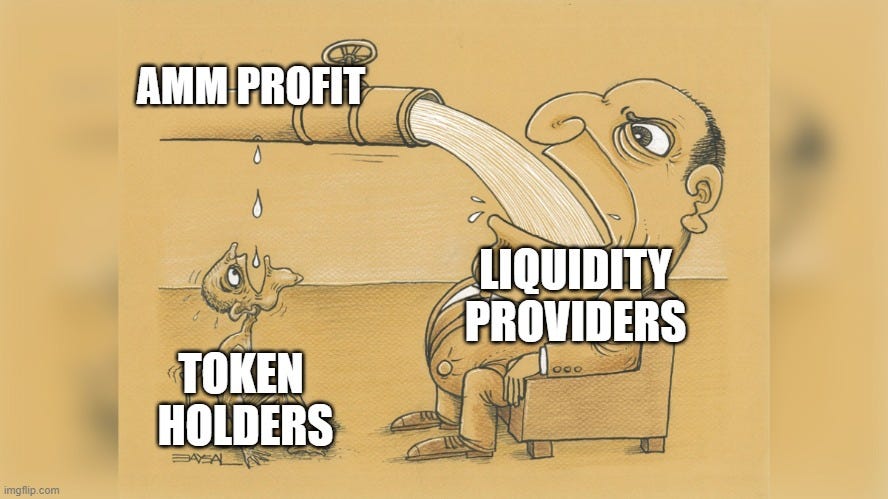

Most (if not all) AMMs are not generating real profit.

Protocols should think about how they can accrue value back to token holders ASAP, especially those with less capital on their treasury reserves.

Protocols can ignore value accrual mechanics so long as their treasury is large enough but to the detriment of token holders.

Protocols can provide their own liquidity and generate real profits with a much smaller capital thanks to concentrated liquidity.

Vertically integrating with other DeFi products (wallets, play-to-earn, etc.) proved to be extremely beneficial for an AMM’s profitability.

In today’s issue:

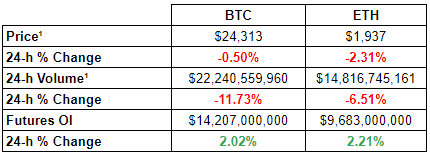

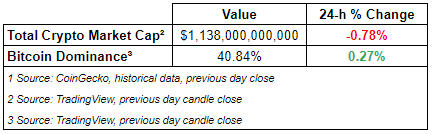

The crypto market is flat with its total market cap above ~$1.1 trillion. Leo Token (LEO) has been the best performer in the top 100 in the past 24-h. China surprised the markets by cutting rates in response to the country’s economic slowdown.

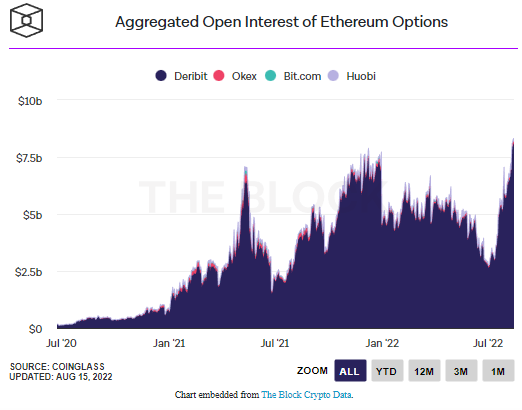

In other news, Do Kwon's first interview since UST collapse, pension funds remain interested in crypto, and ETH options open interest hits an all-time high.

We’re continually improving our content, please reach out if you have ideas or want us to recap another market segment.

- Curated by Marco Manoppo (@manoppomarco)

📰Market News

⎆Do Kwon’s First Interview Since UST Collapse

In his first interview post the UST collapse, Do Kwon stated that the South Korean investigators haven’t reached out to him about the incident.

⎆Pension Funds Remain Interested in Crypto

Despite the ongoing bear market, WSJ reported that pension funds across North America remain interested in crypto as an asset class.

A Quebec pension fund made a $150 million equity investment in Celsius Network LLC last fall. In July, the cryptocurrency lender filed for bankruptcy protection.

A $5 billion retirement fund serving Houston firefighters said last October it had put $25 million into bitcoin and ether. Since that announcement, both cryptocurrencies have fallen by more than 50%.

⎆ETH Options Open Interest Hits an All-Time High

As the Ethereum merge approaches (Sept 15), the open interest in ETH options has reached an all-time high. Traders are using options as an effective tool to speculate on ETH’s volatility without holding direct spot exposure of the underlying asset

👨🏻💻Decentralized Finance (DeFi)

Open Interest in ETH Options Hits All-time High

Acala Exploit

Velodrome Team Wallet Exploit Update

Binance Recovered $450k of the Curve Stolen Funds

Skynet Labs Shut Down

Ethereum Tops $2,000 as Network Approaches Merge Event

Tornado DAO Grapples With Arrests as Discord, Governance Forum Go Dark

Nexus Mutual to Invest $29M of Treasury into Maple Finance

Xenon Protocol is Live

Dfyn v2

Mycelium Perpetual Swaps is Live

🏛Governance - Active Proposals

PoolTogether - PTIP 80 - Treasury Assets Management #2

Yam Finance - Contributors comps for July, claiming sushi for reserves

🦮NFT & Metaverse

Axie Infinity Cuts Rewards from Classic Game

OpenSea Changes Stolen NFT Policy Following User Outcry

Top Sales (Last 24-h); Source: https://dappradar.com/nft

📈Deal Flow & Capital Raise

ReadOn - $2M Seed Round

Datawisp - $3.6M Seed Round

Ankr - Undisclosed $ of Strategic Investment by Binance Labs

DAM - Undisclosed $ of Strategic Investment by Arrington Capital

Archax - Undisclosed $ of Stake Purchase by Abrdn

Celo - Undisclosed $ of Africa Fund

⚖️Regulatory Update

CFTC Accuses Ohio Man of Running $12M Bitcoin Ponzi Scheme

Suspected Tornado Cash Developer Arrested in Amsterdam

📚Noteworthy Reads

Alan Szepieniec’s Read on The Problem of Scalable Privacy

Zee Prime Capital’s Read on Social Web 3

SBF’s Thread on The Financial Circle-Jerk

Feel free to reach out to manoppomarco@gmail.com — feedbacks and constructive criticisms are much appreciated.