Hi folks,

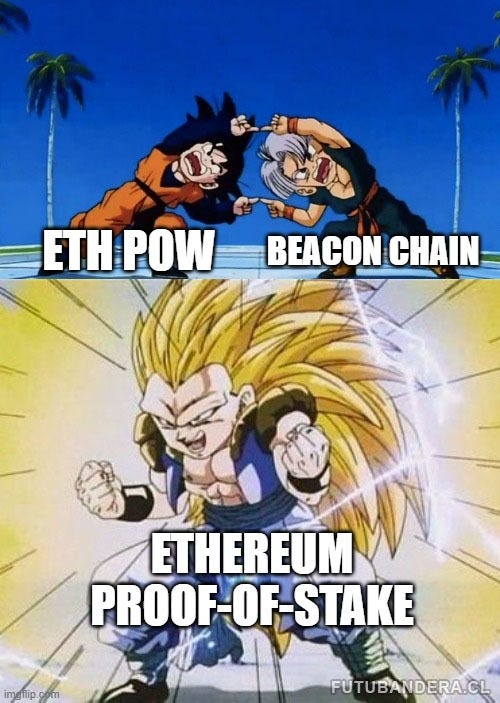

At this point, we’re all aware that the merge is the act of merging the existing Ethereum network with a Proof-of-Work (PoW) consensus with an existing parallel chain that has been running with a Proof-of-Stake (PoS) consensus called the Beacon Chain. It will transition the Ethereum network from PoW to PoS.

Why it matters: Ethereum is the most utilized blockchain with more than $30 billion of value built across decentralized applications built on top of it. ETH is also the second largest crypto asset with close to $200 billion in market capitalization.

The merge will also prove that it is possible to maintain and upgrade a massive decentralized network, further proving that the vision of web 3.0 is feasible.

In today’s issue:

The crypto market is up with its total market cap above ~$1 trillion. Ravencoin (RVN) has been the worst performer in the top 100 in the past 7-d. US inflation print in August is 8.3%

In other news, Do Kwon faces an arrest warrant, BTC mining difficulty reaches ATH, and Compound Treasury debuts crypto loans for institutional clients.

We’re continually improving our content, please reach out if you have ideas or want us to recap another market segment.

- Curated by Marco Manoppo (@manoppomarco)

📰Market News

⎆Do Kwon Faces an Arrest Warrant

The godfather of Terraform Labs, the entity that obliterated multi-billions in value will potentially face jail. A court in South Korea has issued an arrest warrant for him. Kwon is currently located in Singapore.

⎆BTC Mining Difficulty Reaches ATH

BTC mining difficulty reached an all-time high.

Bitcoin’s mining difficulty increased by 3.45% at block height 753,984 to 32.05 trillion hashes.

This is the second significant recent increase. On Aug. 31, the difficulty jumped by 9.26%.

⎆Compound Treasury Debuts Crypto Loans for Institutional Clients

Compound is expanding its institutional arm with a new offering that enables institutional clients to borrow USDC using crypto as collateral. The loans will be open-ended tenures with no set repayment timetable. This will attract a 6% interest rate.

👨🏻💻Decentralized Finance (DeFi)

Kujira Launches Stablecoin USK

StarkWare Introduces Cairo 1.0

Muffin Live on Mainnet

Shell v2 Live on Arbitrum

Optimism Launches Bedrock Alpha Testnet

Arrakis V2 and Arrakis PALM are Coming

Synapse New Design

Secret Chain is Halted

KKR Puts Portion of Private Equity Fund on Avalanche Blockchain

Maker Raises Staked Ethereum Limit to Reduce Reliance on USDC

🏛Governance - Active Proposals

Gitcoin - Gitcoin // Radicle Public Goods Alliance

PoolTogether - PTIP 81 - Extend ETH/POOL LP on Uniswap V2

Tribe NopeDAO - Veto for TIP_123: Deprecate Optimistic Governance and the Tribal Council

Yam Finance - Contributors comps for August

🦮NFT & Metaverse

Mean Girls Set to Make Web3 Comeback as “Crypto-collectibles”

Ubisoft Cools off on NFTs and blockchain, Says It’s in ‘Research Mode’

Top Sales (Last 24-h); Source: https://dappradar.com/nft

📈Deal Flow & Capital Raise

Doodles - $54M Unknown Round

Synquote - $2.8M Seed Round

Goldsky - $20M Seed Round

Alchemy - $12M Venture Capital Fund

⚖️Regulatory Update

FTC Moves to Join Crypto Lender Celsius’ Bankruptcy Case

Uruguay’s Executive Branch Proposes Crypto Bill for Central Bank

Justin Trudeau Attacks Opposition for Recommending BTC as Inflation Hedge

📚Noteworthy Reads

Ouroboros Capital’s Read on How To Build A Successful Convex

Anon753’s Read on Money: The bubble that never pops

Jake Chervinsky’s Thread on OFAC FAQs to Tornado Cash Sanction

Feel free to reach out to manoppomarco@gmail.com — feedbacks and constructive criticisms are much appreciated.