Crypto 2022: 10 Predictions That Actually Take A Stance

The business of guessing the upcoming Meta(s) before they arrive.

This year I have decided to write more crypto content. I constantly fell under the trap of chasing perfection when writing, but I’ve had enough of that and just decided to hit publish. Also, I wished to get this out a few weeks earlier but better later than never I guess.

Anyway, I digress. You’re here for the predictions so let's get straight into it.

This Time It’s Different

The crypto market has had an amazing year. More than $1.5 trillion worth of value was created in the year 2021, tripling the global crypto market cap from ~$700 billion to $2 trillion+.

I’ve been in the crypto space since late 2016. I’m familiar with the euphoria that swept my entire being as I saw my $4M market cap tokens do a 20x in two days and when my two-year-old worthless pixelated NFTs suddenly received a 10x bid from an anon wallet. Likewise, I’m also familiar with the feeling of helplessness when my dog money goes down in value no matter what kind of hedging strategies I’ve deployed when the Night King eventually arrives.

That said, the energy that I’ve felt entering the crypto space in the past 24 months is different. Long gone are the days of a $50M ICO conducted by Professors without any working product, the 100 pages long whitepaper evangelizing enterprise blockchains, and the solution-trying-to-find-a-problem projects that attached “blockchain” to any existing business models.

Hence, while the crypto market rally might seem like it came out of nowhere when BTC broke $20,000 in December 2020, the entire industry has been laying down the foundations during the 3 year-long bear market (2017–2020) that enabled the 2021 rally. Granted it was also exacerbated by a ludicrous amount of money printing, QE, Covid-19, and other volatility-inducing trends that seem to be encapsulating our world in recent years.

Uh oh… did I just write the four most dangerous words in the investment world?

Fast forward to 2022, I believe that crypto as an asset class will no longer be viewed with the same amount of skepticism even if we enter another full-blown bear market and BTC broke below $30,000. The mantra that it's just another tulip bubble no longer works as decentralization, product-market-fit, aligned capital, killer applications, and innovative business models are all combining into one powerful legitimizing force that propels the entire crypto industry forward.

TL;DR — crypto use-cases are more real than ever, despite a few dog money and ponzinomics hype here and there.

2022 Crypto Predictions

One thing that I dislike the most as a reader is when I encounter a “prediction” article and the predictions are all generic statements such as “blockchain gaming is the next big thing” or “layer 1 goes up”.

Duh.

That’s not helping — or at least in my view, not interesting as there’s no clear stance being taken by the author. As the famous Professor that has been called an insufferable numbskull by Elon Musk once said:

The value of a prediction is not accuracy, but the reasoning and conversation that the prediction catalyzes.

Thus, I’m approaching my 2022 crypto predictions with the mindset to be as granular as possible, taking a stance even when it's unclear/challenging to do so. Sit back, relax, and enjoy.

We’ll revisit this prediction every quarter so that I either feel like a genius or we can laugh together at how wrong I am.

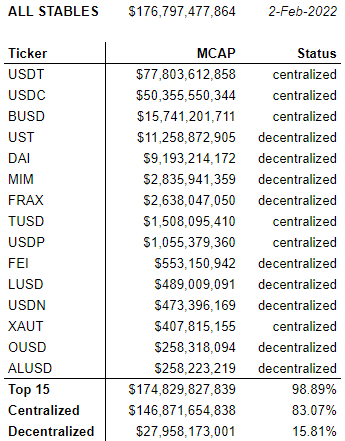

1. Decentralized Stablecoins Capture 50% Market Share

For the longest time ever, there are only two dominant stablecoins in the crypto market, USDT and USDC. Both assets are centralized and controlled by a few entities that are now responsible for more than $125 billion, or roughly 7.35% of the entire crypto market (~$1.7 trillion as of the time of writing).

Regulatory scrutinies towards stablecoins and their providers are at an all-time high due to obvious reasons. An $18 billion market cap dog money might not matter because they’re not considered real by regulators but these stablecoins are the filthy replica of the good old US Dollar. They can’t be left alone without over-the-top supervision even if the percentage of their reserves is astronomically better than most US banks. Granted, stablecoin providers don’t play the same role as banks in our economy, but a 90% plus fractional reserve should be more than sufficient.

Even in DeFi, the majority of trading pairs other than layer 1 assets are conducted in stablecoins, primarily USDC. If a black swan event hits USDC tomorrow such as an absolute ban from the US Government, the entire DeFi ecosystem will be horrendously impacted. Market participants will panic, products won’t work as intended, and liquidity will dry up. Perhaps only momentarily until sophisticated arbitrageurs come in, but I think I’ve made my point clear; the crypto space needs a truly decentralized stablecoin.

As of 2-Feb-2022, the top 15 stablecoins by market cap make up 98.89% ($174.82 billion) of the entire stablecoin market cap. Out of those 15, only 6 are centralized but they make up $146.87 billion or 83.07% of the entire stablecoin market cap. In 2022, we’ll see this number go down to 50% as Decentralized Stablecoins (existing and upcoming) gain market share.

*I’m fully aware that the definition of decentralized here can be debated further. For the purpose of this prediction, stablecoins that store FIAT currency/other non-crypto assets in the banks are considered centralized.

2. ETH Underperforms Despite Layer 2 Success

I love the innovation happening on Ethereum, it is still by far the most exciting chain to be in despite the ludicrously expensive fees. It is exactly like New York. You want to be there because everything is happening there and it's fun, but you’ll hate yourself after paying for $18 salad, $12 pressed juice, and $25 omelette.

Layer 2 will make the Ethereum ecosystem thrives and bring even more TVL to the broader Ethereum ecosystem but even then, ETH will underperform other top layer 1 assets due to market dynamics and value accrual mechanisms of layer 2. ETH's market cap is currently ~10x of SOL’s, which is arguably its best competitor out there. The meme price of $10,000 per ETH will most definitely happen but I have a hard time believing that other layer 1 assets can’t outperform ETH’s 3–4x return at $10,000.

If (or when) layer 2 protocols launch their own tokens, value accrual will also be distributed across these chains just like how they’re distributed to other layer 1 assets. Granted, these layer 2 protocols might not feel the need to do so given they’re extremely well funded equity-wise. However, if they decide to do so, ETH will not benefit and value will be absorbed by layer 2 tokens instead.

Additionally, for institutional capital chasing yield in crypto, it is now easier than ever for them to enter riskier crypto assets down the market cap. Providers such as Grayscale, Coinshares, 21Shares, FTSE Russel, Bloomberg, and others are becoming much more open towards crypto, increasing the speed of their product launches as demand for crypto increases.

3. One Top US-Based Crypto Project Forced to Relocate

Regulations have been ramping up alongside the market in the past 24 months. As a result, we’re seeing much more coordinated efforts from different governing bodies around the world, with increasingly nuanced takes that can both be good and bad for the crypto space. While other financial hubs around the world such as Singapore and Switzerland have been cautiously friendly towards crypto, the United States has shown otherwise.

Perhaps it’s not a surprise given the size of the US capital market and various interests at play. However, even with a new SEC head who’s supposedly knowledgeable about the crypto market, the regulatory environment in the US hasn’t progressed (not friendlier or clearer). Many crypto founders and investors have been voicing out that operating from within the US no longer brings worthwhile benefits given the associated risks. Combined with the fact that crypto is one of the most remote-first industries, I predict that one top US-based crypto project (top 50 by market cap) will relocate due to regulatory pressure.

4. Emerging Markets VCs Enter

Venture Capital funding in crypto has grown exponentially in the past 24 months but the majority of this capital is coming from developed western countries and major financial hubs in emerging market (EM) regions. After witnessing the returns that the crypto market generates and as crypto becomes more integrated with our daily lives, capital allocators in EM that has been predominantly investing in the local copy-paste companies inspired by US unicorns will turn their attention towards crypto instead.

Old money and family offices in EM will also move a lot faster towards crypto as a good majority of them missed out on the web 2.0 tech boom due to being overly conservative in their capital allocation. This even resulted in a significant shift in their local rich list. For instance, Kakao founder unseated Samsung heir as South Korea’s wealthiest person. Their heirs are not going to be as conservative. They don’t want to miss out on crypto.

5. Tokenomics Rework Is a Dominant Theme

Tokenomics re-work will be a dominant theme in 2022. Projects will realize that most of the time, there are no value accrual mechanisms in the associated tokens other than a mere belief that numbers go up. Governance-only tokens will continue to underperform the broader market. New mechanisms will be implemented as projects try and find the best tokenomics model that can really tie value accrual in the protocol back to token holders. In the process, we’ll be witnessing a lot of ponzinomics-esque token mechanics that might or might not work depending on where we’re in the crypto market cycle.

Projects that raise both equity and token rounds will face a very difficult dilemma, especially as regulatory pressure increases. If their product is good enough, they can easily take the equity path and abandon the token holders to please regulators and play it extremely safe; or they can go the degen web 3.0 route and force any capital owners who want to capture value in their protocol to hold the tokens (my preferred method). At the same time, if the tokens hold too much power and become increasingly similar to equity in structure (holds true governance power and ownership of the protocol), regulators might come knocking at the door sooner than expected.

6. A Large Entity Joins the Curve Wars and a Winner Is Determined

Knower, a prolific writer in the space has written two brilliant articles to explain the Curve Wars. See below.

In summary, it is a battle amongst protocols to take ownership of Curve’s liquidity, which powers the stablecoin ecosystem in DeFi.

I predict a large mafia, whether it be the SBF-group, Terra-group, Silicon Valley VCs (a16z, Paradigm), or even new possible entrances (Citadel maybe…?) will join the Curve wars and a winner will be determined before the end of 2022.

7. GameFi Is the Worst Performing Sector

While GameFi has been the hot trend in the past 12 months thanks to Axie Infinity’s success and Facebook’s decision to become Meta, the amount of frothiness in this particular sector of the crypto market is mind-boggling to see. Don’t get me wrong, I think NFTs are eventually good for games — but as an avid gamer myself, I can’t bear to witness the blasphemy that some of these projects did by calling their products “games” in an era where real gaming is one of the fastest-growing industries in our economy.

Thanks to the hype, a lot of GameFi projects also raised capital at ludicrous valuation, often in the billions fully diluted valuation (FDV) without any working products. Even then, the working products are usually copy-paste or pixelated assets which resulted in gameplay that can only be enjoyed by ten-year-olds with no gaming experience. Heck… I take that back. Ten-year-olds these days have much more access to gaming compared to 15 years ago (showing my age), and are probably playing the latest rendition of Pokemon Legends Arcue on their Nintendo Switch.

As a sector, I believe that GameFi will underperform the broader crypto assets in 2020 due to private rounds token unlocks.

Oh and gaming guilds. Can’t believe I almost left that out. Gaming guilds will find it harder to survive as the majority of their business model is predicated on being a mercenary capital that requires them to find the next game to capitalize on, akin to yield farmers with pool 2, but with a much more complex operational workflow. They need to manage scholars while continuously finding and learning the next game to jump on. Otherwise, most of them just become another investment entity that puts their capital to use in other gaming-related projects. It will continue the network effect though, so gaming guilds will most likely stay for the next few years until they discover a new, more suitable business model to implement.

8. ETH Flips BTC Post Merge

This is the simplest prediction that doesn’t require a lot of explanation. Post ETH 2.0 merger, the Ethereum network will be adopting Proof-of-Stake (PoS). Scalability will (fingers crossed) improve and TradFi institutional capital will like the ESG branding associated with PoS. Bitcoin maxi will lose their heads and we’ll need to bear it for a few days as our Twitter timelines get filled by Ethereum maxi victory tweets.

9. PrivaShit Coins

Privacy coins continue to suffer. There will be more privacy applications like Tornado Cash that continue to provide end-users with anonymity if they want, but any token that tries to use privacy as its core value-add thesis won’t work. Either the regulators will come knocking or the product won’t be adopted enough to justify an investment especially if its value add is just [x] but with privacy.

I love my anon founders. They always tweet the best memes. That said, I’m a believer that if somebody really wants to find who you’re on the internet, they will.

10. NFT Branding Gets Worse

This one is better explained via my tweet thread.

If you make it this far, thank you for reading.