Hi folks,

There’s no other communication platform more poised to capitalize on the success of crypto as much as Telegram. The messaging app has been a critical infrastructure for crypto market participants for years. It should start monetizing by providing crypto-related services to lock its crypto users within the platform as much as possible.

Here’s how: Telegram should not start with anything token-related, but should closely integrate crypto-related services in its effort to become profitable.

In today’s issue:

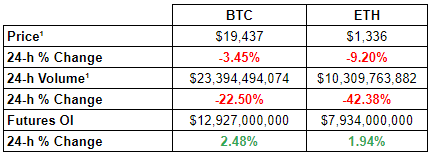

The crypto market is down with its total market cap above ~$900 billion. Ethereum Classic (ETC) has been the worst performer in the top 100 in the past 24-h. Central banks around the world are set to continue raising interest rates.

In other news, Coinbase could earn $1.2B in revenue, SEC disrupts crypto lenders, and Grayscale files for ETHW.

We’re continually improving our content, please reach out if you have ideas or want us to recap another market segment.

- Curated by Marco Manoppo (@manoppomarco)

📰Market News

⎆Coinbase Could Earn $1.2B in Revenue

A JPM analyst predicted that Coinbase could earn $1.2B in revenue in 2023, thanks to raising interest rates.

Coinbase’s joint venture with USDC issuer Circle alone could contribute about $700 million of incremental revenue, JPMorgan estimates. The two firms formed a joint venture in 2018 called the CENTRE Consortium, which included a revenue share on interest income from USDC reserves.

⎆SEC Disrupts Crypto Lenders

The SEC released guidelines that would push up the cost for crypto lenders, making it too capital-intensive for lenders that want to hold crypto tokens to provide services.

The SEC said public companies that hold crypto assets on behalf of clients or others must account for them as liabilities on their balance sheets due to their technological, legal and regulatory risks.

⎆Grayscale Files for ETHW

A fork of the original Ethereum PoW chain went live after Ethereum completed the merge and transitioned to Proof-of-Stake.

Grayscale Investments has the rights to Ethereum Proof of Work tokens as a result of The Merge, and may or may not distribute them to holders in the form of a cash disbursal, the asset manager said in a Securities and Exchange Commission filing on Friday.

👨🏻💻Decentralized Finance (DeFi)

Infura Plans to Launch a New Decentralized Infrastructure Network

Abacus Rebrands to Hyperlane

GMX AVAX/ USD Price Manipulation on

ETHW Exploit

TFM DEX Aggregator is Live on Osmosis

Binance Bungles Accounting for Helium Tokens, Overpays Clients Millions

🏛Governance - Active Proposals

Fei - TIP-121b: Rari Fuse Hack Payment

🦮NFT & Metaverse

Mecha Apps Fake News Confirmed by Co-Founder of Yuga Labs

Opensea Seaport Listings and Offers Posted On-chain

Yuga Labs Hires Chief Gaming Officer

ApeCoin Treasury Set to Unlock 25 Million APE Tokens

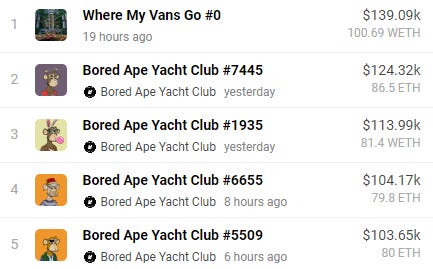

Top Sales (Last 24-h); Source: https://dappradar.com/nft

📈Deal Flow & Capital Raise

Relics - $1.1M Unknown Round

Portofino Technologies - $50M Unknown Round

⚖️Regulatory Update

ECB Picks Amazon, Nexi, 3 More to Prototype Digital Euro Apps

SEC Sues 2 Crypto Advisory Firms

SEC, Ripple Call for Immediate Ruling in Suit

Binance’s Attempt to Buy Voyager Assets Complicated by National Security Concern

📚Noteworthy Reads

Luca Prosperi’s Read on Tribes & Endgames: DAOs Stretching Themselves

3xcalibur’s Read on Undercollateralized Loan

Eva’s Read on Playing Infinite Games

Feel free to reach out to manoppomarco@gmail.com — feedbacks and constructive criticisms are much appreciated.