In today’s issue:

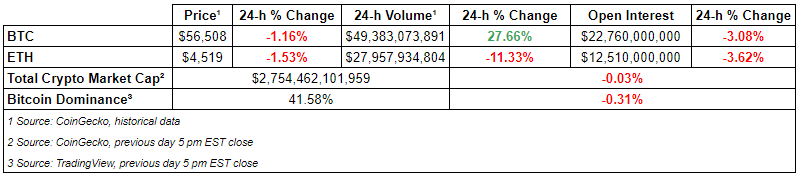

The crypto market is flat with the global market cap sitting slightly above $2.7 trillion. Congress secured a deal to avoid a government shutdown and more FED officials echoed Powell’s message to scale back asset purchases.

In other news, Wall Street banks are exploring BTC-backed loans, Coinbase announces its $30B in staked assets, and BadgerDAO was exploited for $120M.

We’re continually improving our content, please reach out if you have any other ideas or would like us to recap a segment of the market.

- Curated by Marco Manoppo (@manoppomarco)

📰Market News

⎆Wall Street Banks Exploring BTC-Backed Loans

A handful of tier-one US banks is reportedly figuring out how to use BTC as collateral for cash loans. Crypto lenders gained massive popularity in the past few years while also attracting regulatory scrutinies in the past few months. That said, banks have seen the lucrative opportunity they left on the table as firms like NEXO, Celsius, and others gained massive success.

⎆Coinbase $30B AUM in Staked Crypto Assets

Coinbase announced that it has $30 billion worth of crypto assets staked across 25 blockchain networks. The amount includes crypto assets staked in a non-custodial fashion including Coinbase institutional and Coinbase ETH 2.0 staking services. As more crypto assets adopt Proof-of-Stake due to numerous reasons (ESG, scalability, etc.), we’ll continue to see the number of staking service providers grow.

⎆BadgerDAO $120M Front-End Exploit

BadgerDAO, a DeFi protocol focused on providing yield for BTC, got exploited for $120M through a front-end attack. It was reported that the front end of BadgerDAO’s website was compromised instead of the smart contracts. The investigations are currently still ongoing with an admin saying that it appears the Cloudflare API key was compromised.

👨🏻💻Decentralized Finance (DeFi)

Hybrid AMM DeversiFi Delivers Airdrop and Trading Rewards

On First Anniversary Ethereum 2.0 Beacon Chain Solidifies PoS Shift

Push to Launch Layer 2 Liquidity Mining on Uniswap Gains Steam

Iota Set to Launch Decentralized Smart Contract Platform

Filecoin Might Have a Way for Bitcoin to Fight Its Energy Critics

TVL in DAOs Almost Doubles to $15B in Q4 Surge

🏛Governance - Active Proposals

PoolTogether - PTIP-48: Grants Committee Funding (Season 2)

Gitcoin - dCompass Q4 Budget request

🦮NFT & Metaverse

Blockchain.com Follows Coinbase and FTX, Opens NFT Marketplace

Adidas Enters Metaverse With Bored Ape Yacht Club Ethereum NFT

Star Trek Creator’s Signature Goes Where No NFT has Gone Before: DNA

Deadmau5 and Portugal The Man Release Single as 1M NFTs in Bid to Go Platinum

First NFT-focused ETF Lists on NYSE Arca

Diplo, DJ Khaled, Future and Martin Garrix Snap Up NFTs Through MoonPay’s Concierge Service

Top Sales (Last 24-h); Source: https://dappradar.com/nft

📈Deal Flow & Capital Raise

Ambire - $2.5M Unknown Round

ParaFi Capital - $30M New Crypto Fund

Maven 11 Capital - $120M Crypto Fund

TeraWulf - $200M Debt and Equity Financing

⚖️Regulatory Update

South Korea Delays Plans to Tax Crypto to 2023

SEC Rejects WisdomTree’s Spot Bitcoin ETF Application

Senator Warren Targets Bitcoin Miner Greenidge’s Environmental Footprint

SEC Charges Operator of ICO and Cloud Crypto Mining Schemes

📚Noteworthy Reads

Sam Trabucco’s Thread on Efficiency

Delphi Digital’s Thread on Introducing Lockdrop + LBA

Beachon Chain Updated Roadmap

Feel free to reach out to manoppomarco@gmail.com — feedbacks and constructive criticisms are much appreciated.

DISCLAIMER:

All the information presented on The WAGMI Journal publication and its affiliation is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, and any other forms of advice. Writers, authors, and contributors of The WAGMI Journal may hold any assets mentioned in the issue.