Aave Institutional Product Goes Live - The WAGMI Journal #56

DeFi polarization will continue to grow in 2022.

In today’s issue:

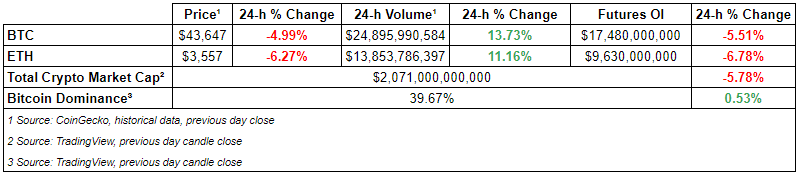

The crypto market is down with the global market cap sitting at ~$2-2.1 trillion. Not a single non-stable crypto asset in the top 100 generated a positive in the past 24-h. This drop is partly because global markets are concerned with the Fed’s minutes, which implies that rate hikes might come earlier than originally expected.

In other news, Aave launched its institutional product, BTC price (and hashrate) fell as $800M+ were liquidated, and Electric Capital’s report stated that other layer 1 developer ecosystems are growing at a faster rate than Ethereum did.

We’re continually improving our content, please reach out if you have ideas or would like us to recap another segment of the market.

- Curated by Marco Manoppo (@manoppomarco)

📰Market News

⎆Aave Arc Goes Live

The notable crypto lending platform has finally added its institutional product called Aave arc, which is a permissioned liquidity pool that mandates participants to comply with regulatory rules. Serving as Aave’s whitelisting agent, Fireblocks is also Aave Arc’s first user out of the 30 entities that have lined up for the product. My prediction, in the next 12 months, we’ll see further polarization in the DeFi ecosystem.

⎆BTC Price & Hashrate Fell

Its been a tough few days for BTC as the crypto asset price fell to $43,000 with more than $800M in positions liquidated in the past 24-h. Additionally, Kazakhstan's effort to curb power shortages by limiting crypto mining has affected the Bitcoin’s network hashrate, as more than 15% of mining pools are based in the country.

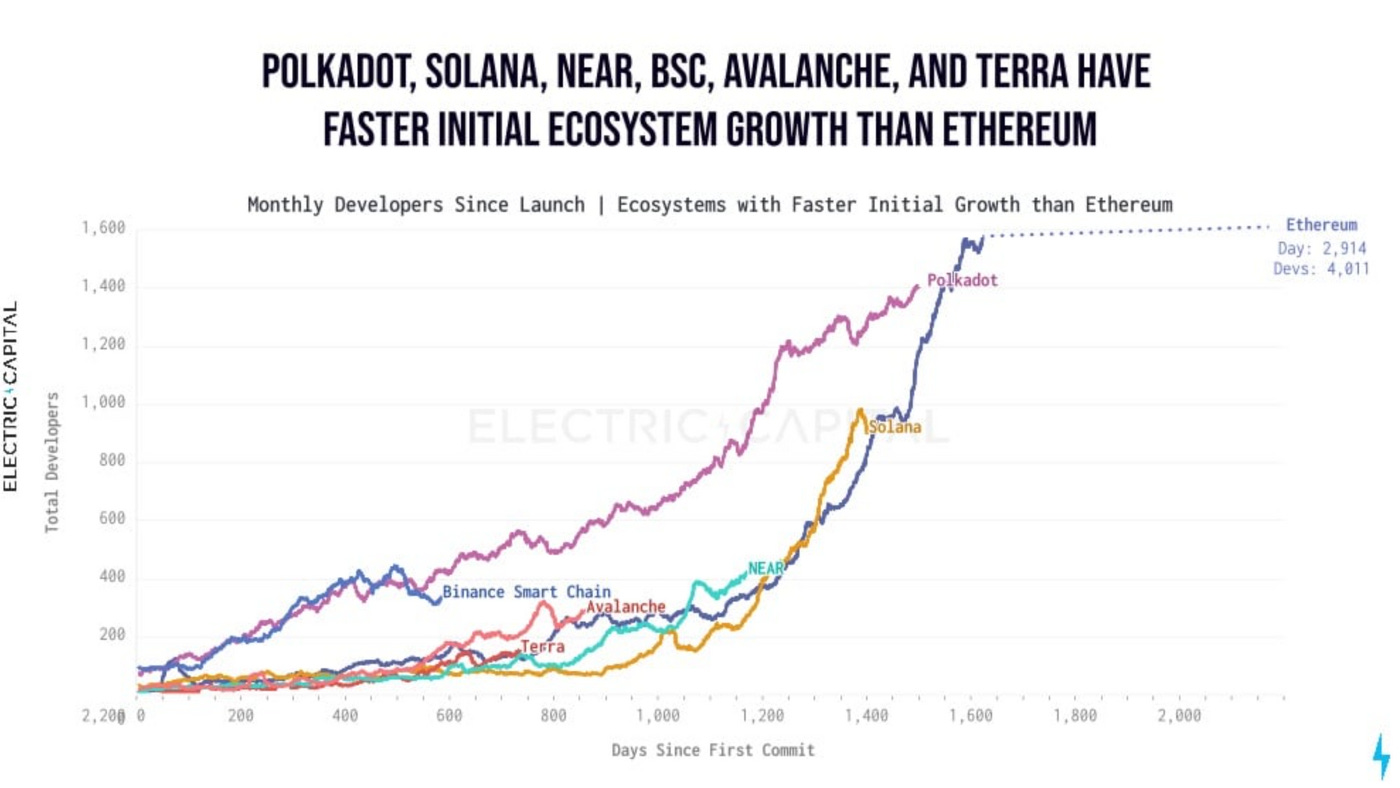

⎆Layer 1 Developer Ecosystems Growth

In its annual developer ecosystem report, Electric Capital showcased that other layer 1 blockchains have been experiencing a faster developer growth in comparison to Ethereum in its early days. Polkadot and Solana are the two closest to Ethereum based on the total number of developers.

👨🏻💻Decentralized Finance (DeFi)

Aave’s New Institutional Platform Attracts 30 Institutional Players

BitGo Deal with Index Coop in Bet Institutions Want ‘Thematic’ DeFi Tokens

Boba Network Introduces Boba's WAGMI Incentive Program

OlympusDAO Rolls Out $3.3M Bug Bounty Program

Illuvium Team Drains sILV Uniswap Pool in Bid to Prevent Exploit Cash-Out

Polkadot Gets DeFi Building Block as DEX Aggregator Dot Finance Migrates

Ondo Finance Partnership with Frax

Metis Introduces Builder Mining Program

🏛Governance - Active Proposals

Babylon Finance - BIP-7: Mining Adjustments

ENS - [EP2] Retrospective Airdrop

🦮NFT & Metaverse

Binance Introduces NFT Subscription Mechanism

Blockchain and the Metaverse Make Inroads at Consumer Electronics Show

Why Kevin O'Leary Thinks NFTs Could Become Bigger than Bitcoin

Australian Open Apes Into Tennis NFTs and Decentraland

Drone Racing League Zooms Into Metaverse, Bringing P2E to Algorand

Singapore Tycoons’ Sons Plan Private NFT Club

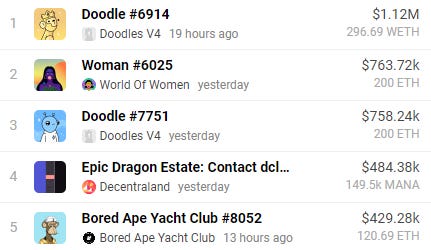

Top Sales (Last 24-h); Source: https://dappradar.com/nft

📈Deal Flow & Capital Raise

Coin98 - Unknown Amount at Unknown Round by Binance Labs

Exotic Market - $5M Unknown Round

CryptoSlam - $9M Unknown Round

Sygnum - $90M Unknown Round

First Ledger Corp - $162M Acquisition by WonderFi Backed By Kevin O’Leary

⚖️Regulatory Update

UK’s Advertising Regulator Bans 2 Crypto.com Ads

Congress is Preparing an Oversight Hearing on Bitcoin Mining's Environmental Impact

Thailand’s Crypto Traders to Be Subject to 15% Capital Gains Tax

📚Noteworthy Reads

The Block’s Read on The Block Research’s Analysts: 2022 Predictions

Andre Cronje’s Read on ve(3,3)

Electric Capital’s Research Report on 2021 Crypto Developer Ecosystem

Feel free to reach out to manoppomarco@gmail.com — feedbacks and constructive criticisms are much appreciated.