In today’s issue:

The crypto market is flat with the global crypto market cap still sitting above $2.7 trillion. The Sandbox (SAND) is one of the few larger market cap tokens that generated a significant return in the past 24h — its Alpha will be launched on November 29, 2021. In other news, Mt. Gox creditors are finalizing the repayment plan, Crypto.com announced its massive $700M deal, and the CFTC released the Digital Commodities Exchange Act.

Starting today, our daily issue will be sent out before 9 am EST.

We’re continually improving our content — based on our readers’ suggestions, we are working to add:

a section showing open interest and other trading-related metrics 24-h changes

a section showing newly released projects

Please reach out if you have any other ideas or would like us to recap a segment of the market.

- Curated by Marco Manoppo (@manoppomarco)

📰Market News

⎆Mt. Gox Repayment Plan

Mt. Gox, one of the largest crypto exchanges from the 2014 era, is continuing its long-running saga as creditors of the now-defunct exchange are finalizing a plan that to reimburse its old users. When this plan eventually passes, there will be approximately 141,686 BTC ($8 billion ++) to be distributed. Having said that, see below:

⎆Crypto.com $700M Staples Center Naming Rights

Perhaps following in the footsteps of FTX, the Singapore-based exchange announced that it has secured the naming rights to the Staples Center for $700M. The deal will also welcome the Lakers as Crypto.com’s partners. As a push to garner more users, we’ve seen crypto exchanges sponsoring sports and eSports-related entities; which is a smart move as the target audiences are generally in a similar cohort, young and digital natives.

⎆CFTC Released the Digital Commodities Exchange Act

Congressman Glen Thompson has released the Digital Commodities Exchange Act (DCEA) which would establish a voluntary regulatory regime for crypto exchanges under the CFTC. The bill would establish a new regulatory regime for crypto exchanges at the CFTC. Currently, spot markets have no federal regulator in the U.S., though that is a contentious subject. We’ve also been seeing both the SEC and CFTC actively trying to create frameworks and arguing to have more jurisdiction over the crypto market.

👨🏻💻Decentralized Finance (DeFi)

Injective Protocol Launches Mainnet, $120M Incentive Program

0L Aims To Revive Facebook’s Libra Cryptocurrency With Fair Launch

Sablier Finance Deploys Payroll Streaming to Polygon and BSC

Polygon Launches a zk-STARK Scaling Solution for DApp Deployment

Iota Foundation to Launch Staging Network and Reward Token

Saddle Finance Announces SDL Token Airdrop

IoTeX ‘MachineFi’ Rebrand Backs 200%+ Rally to a New All-time High

Deloitte, Ava Labs Link Up in Bid to Streamline Natural Disaster Reimbursements

🏛Governance - Active Proposals

Elyfi - NAP5: Request for verification of ABToken

Idle - IIP-16: Upgrade PriceOracle to support new compSupplySpeeds

🦮NFT & Metaverse

Sandbox Metaverse Alpha Launches Nov. 29 After Four Years in Development

Quentin Tarantino Sued by Miramax Over Pulp Fiction NFTs

Supply Chain Meets NFTs in New Offering From Enterprise OG MultiChain

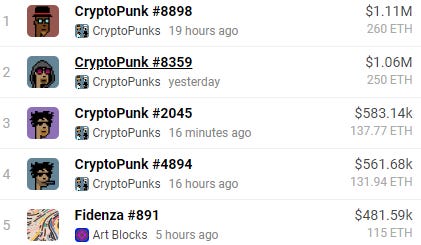

Top Sales (Last 24-h); Source: https://dappradar.com/nft

📈Deal Flow & Capital Raise

Arrow Markets - $1.4M Unknown Round

GALLERY - 2.69M Unknown Round

PStake - $10M Unknown Round

Kosen Labs - $5M Seed Round

NFTfi - $5M Seed Round

CyberConnect - $10M Seed Round

Starkware - $50M Series C

KuCoin - $100M Metaverse Venture Fund

Injective Protocol - $120M Incentive Program

Ethereum Foundation - $1M Grant

⚖️Regulatory Update

DOJ to Sell $56M in Crypto Proceeds From BitConnect Fraud Scam

Ripple Outlines Possible Regulatory Framework for Crypto Industry in the US

Blueprint for CFTC Regime Over Crypto Exchanges Enters Congress

Kraken Subsidiary Crypto Facilities Receives FCA Approval in The UK

Brian Quintenz Joins Board of The First CFTC-regulated 'Events Market'

Ted Cruz Seeks Repeal of Biden Infrastructure Bill's Crypto Broker Definition

Israel’s New AML Rules May Help Banks Onboard Crypto Clients

India to Ban Crypto As Payment Method, But Regulate As Asset: Report

Peru’s Central Bank Is Developing a CBDC

📚Noteworthy Reads

Hermant Mohapatra’s Thread on Lightspeed’s India & SEA Crypto Market Map

Oliver Jumpertz’s Thread on Rust Programming Language

Lightspeed Venture Discussion with Do Kwon of Terraform Labs

Feel free to reach out to manoppomarco@gmail.com — feedbacks and constructive criticisms are much appreciated.

DISCLAIMER:

All the information presented on The WAGMI Journal publication and its affiliation is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, and any other forms of advice. Writers, authors, and contributors of The WAGMI Journal may hold any assets mentioned in the issue.