Hi folks 🙋🏻♂️,

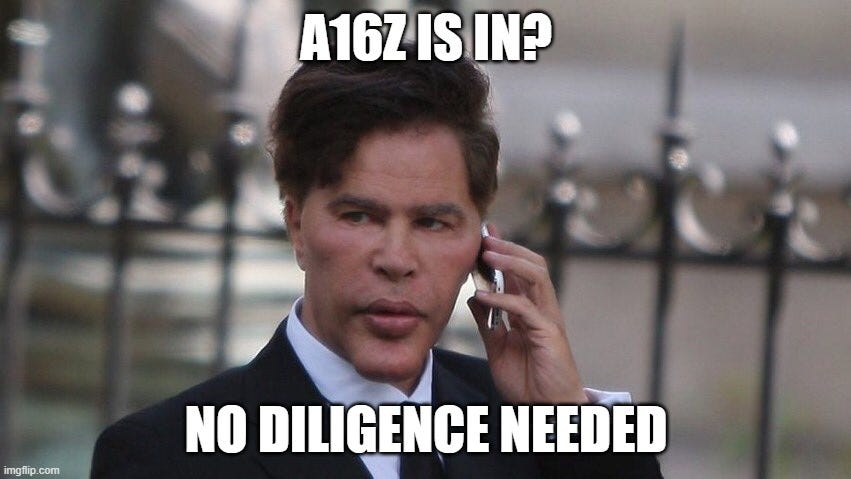

On September 28, @codygarrison_ from Clearblock released a web3 VC ranking database for founders to better understand the crypto VC landscape. I’ve always loved the idea of reverse accountability. Auditing the auditors, regulating the regulators, and doing diligence on the VCs. Clearblock did a good job providing scores for these VCs, so I’m going to focus on the financials aspect instead.

Here are the quick takeaways:

Private markets are often opaque, which makes it difficult to get a clear understanding of a fund’s compensation structure and financial health.

Investment DAO can lead the way in improving a fund’s transparency by storing everything on-chain.

As founders or young investment professionals, scrutinizing the VC firms themselves as a business is crucial.

The bull market gave rise to many new VC firms, which deserve more diligence as they themselves can be considered “startups” also.

VC is a “top-heavy” business — the majority of the value capture goes towards the founders and General Partners. Understanding this dynamic when one is raising capital is critical to find the best fit for your startup.

In today’s issue:

The crypto market is flat with its total market cap above ~$900 billion. GMX (GMX) has been the best performer in the top 100 in the past 24-h.

In other news, Fidelity launches an Ethereum index fund, Elliptic reports $4 billion laundered through DeFi, and Flashbots addresses censorship concerns.

We’re continually improving our content, please reach out if you have ideas or want us to recap another market segment.

- Curated by Marco Manoppo (@manoppomarco)

📰Market News

⎆Fidelity Launches an Ethereum Index Fund

The $4.5 trillion financial service firm has launched a new Ethereum Index fund that will provide clients exposure to ETH. There’s a minimum investment amount of $50,000 and currently only showed around $5M+ in reported sales.

⎆Elliptic Reports $4 Billion Laundered Through DeFi

On-chain analytics firm Elliptic published the state of cross-chain crime report which stated that approximately $4 billion of digital assets have been laundered using DeFi tools such as DEXs, cross-chain bridges, and AMMs.

⎆Flashbots Addresses Censorship Concerns

Robert Miller, a product lead at Flashbots, has responded to the public concerns regarding its influence in the MEV market, which could potentially make Ethereum more censorable. He stated 3 ways in which Flashbots will reduce its influence, further decentralizing Ethereum and making it more censorship-resistant.

👨🏻💻Decentralized Finance (DeFi)

Euler is Supported on Aztec’s 4626 Bridge

Bond Protocol Beta is Live

Osmosis is Down Temporarily

GMX Backend Contract Code for Synthetics is Live

Sovryn Exploit

Chicken Bonds is Live on Mainnet

Magna is Live on Arbitrum

$AVAX is Live on THORChain Mainnet

Fantom Lower Validator/ Staking Reward Proposal Passed

🏛Governance - Active Proposals

Hop - Hop Proposal Bundle: HIPs 0-7, SNX/sUSD Bridging Support

🦮NFT & Metaverse

Three Arrows Capital Fund Moves over 300 NFTs to a New Address

DataVault Requests US Election Agency’s Advice to Send NFTs as a Campaign Fundraising Incentive

Latin Grammy Awards Signs 3-year Contract for Award Show NFTs

VeeFriends Toys Coming to Macy’s, Toys'R'Us

Japan to Invest in Metaverse and NFT Expansion

Top Sales (Last 24-h); Source: https://dappradar.com/nft

📈Deal Flow & Capital Raise

Horizon - $40M Series A

M31 Capital - $100M Web3 Opportunity Fund

⚖️Regulatory Update

Coinbase Supportive of Giving CFTC Exclusive Jurisdiction Over BTC, ETH

EU Seals Text of Landmark Crypto Law MiCA, Fund Transfer Rules

SWIFT Says It's Proved It Can Be the Way Forward for Global CBDCs

📚Noteworthy Reads

Viktor DeFi’s Thread on Masterclass on Etherscan

Thor Hartvigsen’s Thread on Arbitrum

DeFi Cheetah’s Thread on GMX Research

Feel free to reach out to manoppomarco@gmail.com — feedbacks and constructive criticisms are much appreciated.